TMCnet News

Knowledge Leaders Developed World ETF Marks 3-Year Milestone, Continues Record of OutperformanceKnowledge Leaders Capital today marked the 3-year anniversary of the Knowledge Leaders Developed World ETF (KLDW). An alpha-seeking ETF that seeks to capture the excess returns of highly innovative companies, KLDW has continued its record of outperformance since inception, as of 6/30/18 (NAV). This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180716005148/en/

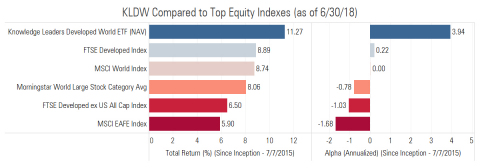

KLDW Compared to Top Equity Indexes (as of 6/30/18) (Graphic: Business Wire) The Knowledge Leaders ETF's track record reinforced -- now for the third year running -- the tendency of Knowledge Leaders to deliver excess returns in the stock market. In fact, KLDW delivered greater total return and alpha (a measure of excess returns) than all four of the top benchmark indexes tracked by core equity ETFs, as of 6/30/18, for the since inception period, as well as the fund's Morningstar category average. KLDW standardized performance: as of 6/30/2018, the total returns for the Knowledge Leaders Developed World ETF NAV and market price, respectively, were 12.23% and 11.65% (1-year) and 11.27% and 11.27% (since inception). The expense ratio for the ETF is 0.75%. The inception date is 7/7/2015. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. NAV prices are used to calculate market price performance prior to the date when the fund first traded on the New York Stock Exchange. Market performance is determined using the bid/ask midpoint at 4:00pm ET, when the NAV is typically calculated. Market performance does not represent the returns you would receive if you traded shares at other times. For the Fund's most recent month-end and quarter-end performance, please visit www.knowledgeleadersfunds.com/kldw/. For the alpha comparison, data is benchmarked vs. the MSCI World Index. KLDW's investment strategy is based on capturing the Knowledge Effect, the tendency of highly innovative companies to generate excess returns in the stock market. As KLDW's performance demonstrates, the Knowledge Effect has been persistent across economic factors and consistent through time since inception. KLDW is a diversified ETF offering core exposure to the developed world's most innovative companies. Learn more at Knowledge Leaders Developed World ETF. Follow KLDW on Twitter (News - Alert) at @KLDWETF. About the Knowledge Leaders Developed World ETF The Knowledge Leaders Developed World ETF is the first ETF designed to capture the Knowledge Effect, a market anomaly by which highly innovative companies tend to generate excess returns in the stock market. The firm's flagship Knowledge Leaders Strategy seeks to transform the Knowledge Effect into portfolio alpha. The Knowledge Effect is grounded in academic literature. It was first discovered in a series of studies in the 1990s where New York University's Baruch Lev analyzed 20 years of financial data and discovered an association between a firm's level of knowledge capital and its subsequent stock performance. Further research advanced the findings, and in 2005, Lev proved the existence of a market inefficiency attributable to missing information about knowledge investments. This phenomenon leads highly innovative companies to deliver persistent abnormal returns. Read the white paper on the Knowledge Effect in "Featured Research" at Knowledge Leaders Capital. About Knowledge Leaders Capital Knowledge Leaders Capital identified the Knowledge Effect and created the first investment methodology designed to capture the excess returns of highly innovative companies. Knowledge Leaders Capital is creator and designer of the Knowledge Leaders Strategy, indexes and investment products. Learn more at Knowledge Leaders Capital or email [email protected]. Important Information and Risks Please consider the Fund's investment objectives, risks, charges and expenses before investing. The prospectus or summary prospectus that contains this and other information about the Funds is available by calling 844-428-3525 and should be read carefully. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. Currency Risk is the risk that the values of foreign investments may be affected by changes in the currency rates or exchange control regulations. Investments in foreign securities may involve risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets. The Fund's return may not match or achieve a high degree of correlation with the return of the Index. As of 6/30/2018, the annualized total returns for the MSCI World Index was 11.09% (1-year) and 8.74% (since inception of the ETF). As of 6/30/2018, the annualized total returns for the FTSE Developed Index was 11.03% (1-year) and 8.89% (since inception of the ETF). As of 6/30/2018, the annualized total returns for the FTSE Developed ex US All Cap Index was 7.52% (1-year) and 6.50% (since inception of the ETF). As of 6/30/2018, the annualized total returns for the MSCI EAFE Index was 6.84% (1-year) and 5.90% (since inception of the ETF). The Knowledge Leaders Developed World ETF is distributed by Foreside Fund Services, LLC. Foreside Fund Services, LLC is not affiliated with Knowledge Leaders Capital. Alpha is a measure of the portfolio's risk adjusted performance. When compared to the portfolio's beta, a positive alpha indicates better-than-expected portfolio performance and a negative alpha worse-than-expected portfolio performance. The Morningstar World Large Stock category is comprised of investment products that invest primarily in large cap stocks across multiple countries. The FTSE Developed Index is a market-capitalization weighted index representing the performance of large and mid-cap companies in developed markets. The FTSE Developed ex-US All Cap Index is part of a range of indices designed to help US investors benchmark their international investments. The index comprises large, mid and small cap stocks from developed markets excluding the US. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia, and the Far East, excluding the US and Canada. An investor cannot invest directly in an index. Shares of the Funds may be sold throughout the day on the exchange through any brokerage account. However, shares are not individually redeemable, and may only be redeemed directly from the Fund by Authorized Participants, in very large creation/redemption units. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Shares may trade above or below NAV. View source version on businesswire.com: https://www.businesswire.com/news/home/20180716005148/en/ |